Recurring payments have become increasingly common in today’s digital economy. Rather than making manual payments each cycle, consumers and businesses alike can now rely on systems that automate the process entirely.

In Indonesia, adoption of recurring payments is steadily growing, fueled by the rise of e-commerce and fintech. A 2019 survey by PwC Indonesia found that around 30% of Indonesian consumers had already used recurring payment systems to settle monthly bills.

But is this method truly the right approach for managing regular payments? Let’s explore what recurring payment is, and whether it offers real value for your business.

The Meaning of Recurring Payment

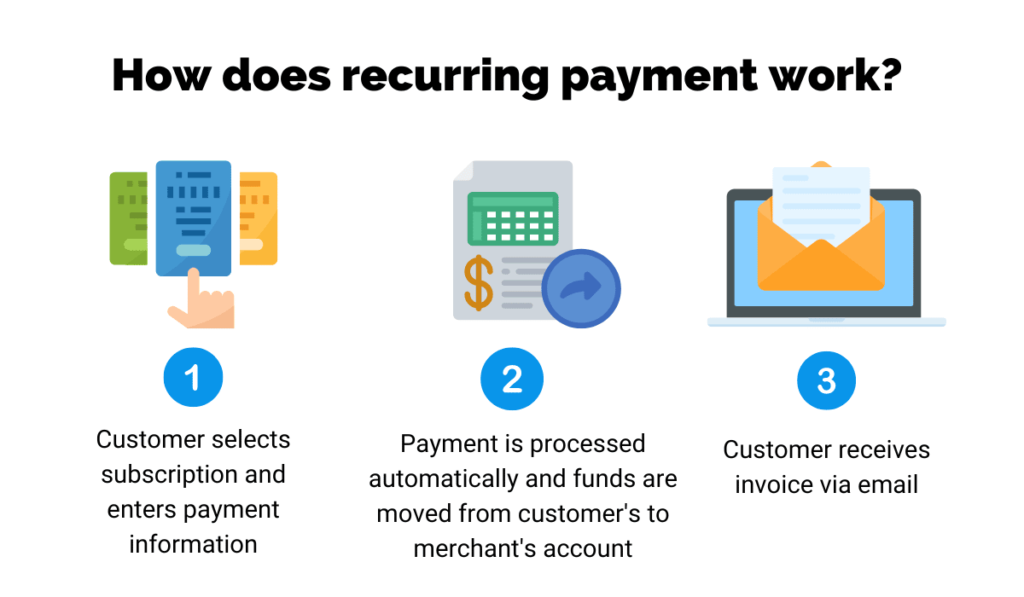

A recurring payment is a billing arrangement where transactions are processed automatically on a fixed schedule—monthly, annually, or based on another agreed timeline.

With this system in place, customers no longer need to initiate payments manually each time. Instead, payments are handled automatically, making the process smoother, faster, and more reliable.

Consider this example: Tio runs a catering business and serves a client—PT. Adi Makmur—on a monthly basis over the course of a year. Under a manual billing setup, Tio would need to issue 12 separate invoices—one each month.

But with a recurring payment system, he only needs to set up the invoice once, and the system takes care of the rest, issuing invoices automatically each month. It’s that straightforward.

Read more: Pay Invoice from Home with Digital Payment Paper.id

Why Consider Recurring Payments?

For business owners, recurring billing systems offer more than just convenience—they support healthier operations and more predictable financial planning.

Some key advantages include:

- Time savings – eliminate the need to create repetitive invoices

- Improved payment consistency – customers are more likely to pay on time

- Greater professionalism – strengthens trust and reliability in customer relationships

- Simplified financial management – keep your business cash flow on track with fewer administrative burdens

Read more: Visa & Paper.id Collaboration: Business Payment Innovation to Streamline Cash Flow

The State of Recurring Payment Software in Indonesia

While recurring billing is still relatively new in Indonesia, awareness is growing. Many businesses have yet to fully embrace this approach simply because they aren’t familiar with the tools available.

That’s where Paper.id comes in.

With Paper.id, you can automate billing, track payments, and ensure smoother operations—all within one intuitive platform. For supplier payments, the PaperPay Out feature offers added flexibility and ease.

Looking to streamline your operations and modernize your billing process? Sign up today and discover how Paper.id can help you take control of your business finances.

- Get Special Promos from BRI , Check Here! - September 18, 2023

- Get Free Paper+ 3 Month with BNI - September 18, 2023

- Blibli Promo Extended, Get It Now! - September 18, 2023